The consultancy PWC called 2017 a “remarkable year” in its annual look back at the health of the mining sector.

After the forced financial reckoning, mining companies are now profitable with metal prices on the rise.

“Thanks in large measure to the continuing recovery in commodity prices, fuelled by general economic growth, revenues rose dramatically by 23 per cent,” writes the reports authors of Mine 2018, Tempting Times.

“At the same time, the cost saving strategies of the past few years delivered, with margins and cash generating ability improved as well, leading to a sharp increase in profits.”

With miners more flush, the top concern is acquisitions. The report’s authors say miners must avoid the temptation to acquire projects at “any price.”

“While we expect capital expenditure to increase next year as companies implement their long-term growth strategies, miners must be careful to maintain discipline and transparency in the

allocation of capital.

“They need to resist the urge to pursue projects or acquisitions at any price, and instead, focus on mining for profit, not for tonnes.”

Here are four of our favourite charts from the survey. Please go read it.

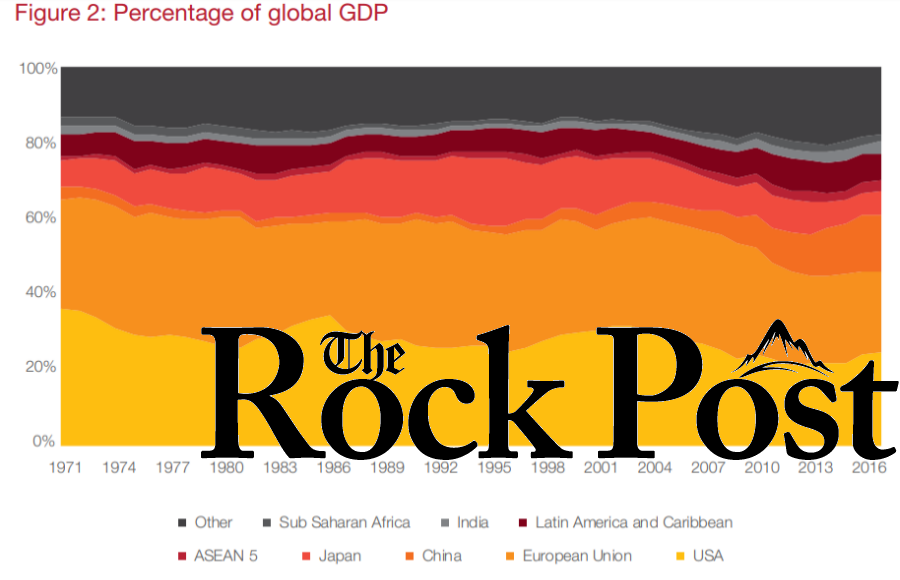

The mining story isn’t all about China. While the Middle Kingdom is a huge commodity consumer, there is robust growth worldwide that is propping up mining. Forty per cent of global GDP comes from USA and Europe.

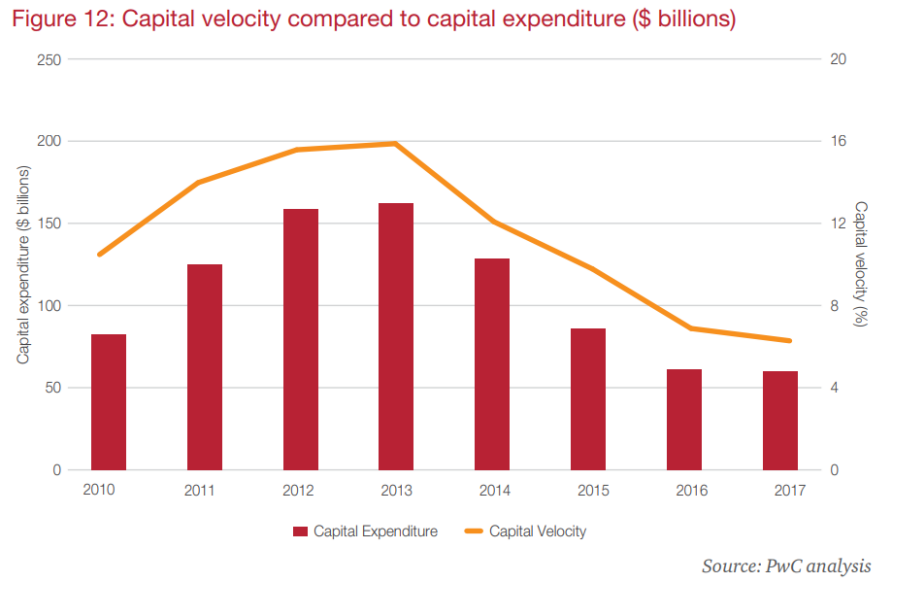

While miners are in a much better place financially, capital expenditure is still at a 10-year low. PWC estimates a two-year lag between a movement in EBITDA and a change in capital expenditure. “After a number of years of record low capital expenditure, we expect next year’s level to increase as companies press ahead with long-term strategies, be it growth through greenfield or brownfield investments, or new acquisitions.”

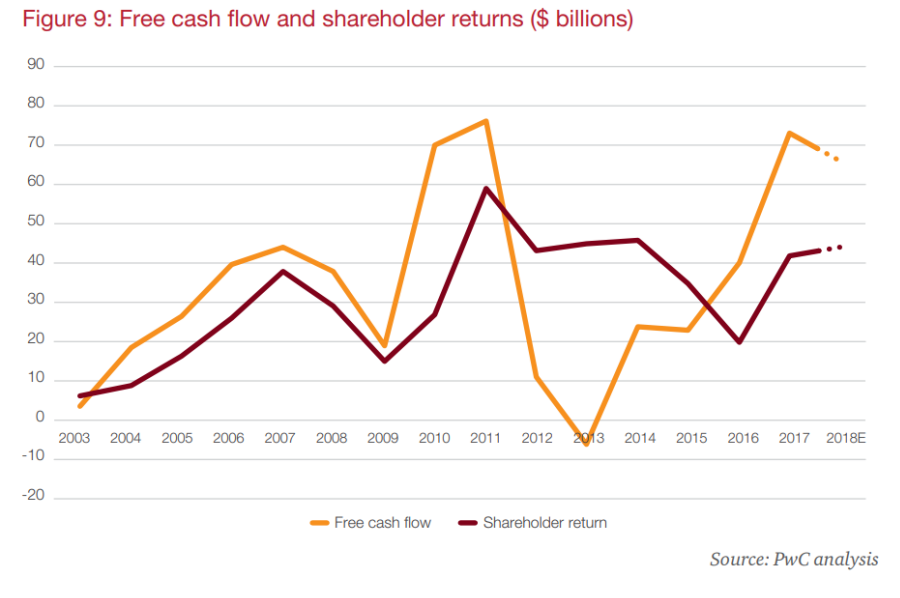

Patient shareholders in 2017 were finally rewarded with more cash for dividends and share buybacks. PWC notes that Anglo American reintroduced its dividend , which was suspended in 2016, and Rio Tinto paid a record level dividend of $5.2 billion in addition to an announced $4.5 billion share buyback.

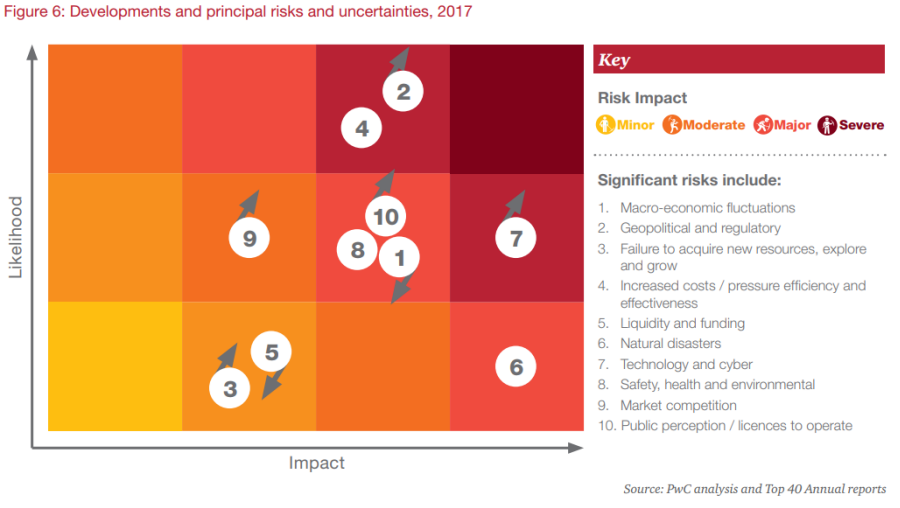

With the upswing in commodity prices, the concerns of miners have shifted. All items moving up and to the right are “failure to acquire new resources, explore and grow”, “technology and cyber”, and “market competition”.

The post Our four favourite charts from PWC’s mining industry survey appeared first on MINING.com.

Source: Mining.com