A new report by Fitch Solutions Macro Research states that despite coal being an increasingly targeted commodity on environmental protection grounds, the demand remains strong due to the economic aspect of the fossil fuel and therefore producers will see improving financials over the coming years.

According to Fitch, major coal miners have already displayed positive financial performance in FY2017 and H118, aided by the significant rally in coal prices and better management strategies. In the researcher’s view, this trend is likely to go on.

“For instance, the world’s largest coal miner China Shenhua Energy’s net debt to EBITDA decreased from 1.0x in FY2015 to 0.2x in FY2017. US coal miner Peabody Energy Corp’s net debt to EBITDA also decreased substantially from 40.7x in FY2016 to 0.1x in FY2017 after the company filed for chapter 11 bankruptcy in 2016 and streamlined its operations. While not a dedicated coal miner, diversified miner Glencore with significant exposure to coal and a reputation of prioritising coal at a time when others are exiting the industry continues to lower its debt load. The company’s net debt reduced to $10.7 billion in FY2017 compared to $15.5 billion in FY2016. The company’s debt to EBITDA ratio is at a multi-year low of 2.7x,” the report reads.

Fitch suggests that Asian producers will continue to outperform in terms of financial gains due to proximity to demand markets and availability of deposits, while producers in western countries including the United States and Europe will face increasing costs and greater environmental scrutiny.

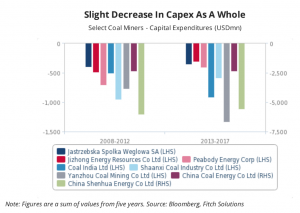

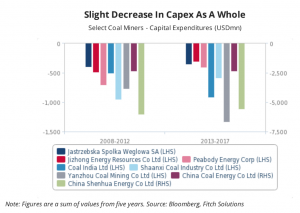

In its outlook, Fitch considers that although times are tempting for miners to resume aggressive acquisitions amid better performance and a pickup in coal prices, it is not expected that they will increase capital expenditures significantly. “This is because as a group, coal miners are still low on free cash flow although firms including China Shenhua, Coal India and Adaro Energy that have substantially better balance sheets distort the total. Compared to a total of $11.8 billion spent on capex in FY2016 by the top 33 coal mining companies on Bloomberg’s top coal mining competitive peers Index, spending got reduced to $9.6 billion in FY2017,” the firm’s document states.

In this context, it is expected that capex for most coal miners will mostly be spent on sustaining existing operations, innovation to improve operational efficiency, and expanding growth assets as minimal investment in greenfield projects will continue.

This is particularly the case for US miners, who will see cost inflation become a larger challenge because it will eat into margins. In Q118, the three largest US coal miners, including Cloud Peak Energy and Arch Coal, reported higher y-o-y costs per tonne, citing higher fuel costs, repairs, and lower volumes sold.

According to Fitch, Chinese miners will also be at a disadvantage despite the weakening Chinese yuan that will work to offset some losses. “For instance, production costs, including transportation, depreciation and tax, jumped 11% on average to about CNY272/tonne of coal mined in FY2017 at China Shenhua Energy, China Coal and Yanzhou Coal. Costs at midsize Chinese mines rocketed by 17% to about CNY328/tonne of coal mined in FY2017 according to Bloomberg. Additionally, increasing mine-safety and emissions standards as per the country’s strict adherence to environmental targets and substantial compensation payments to displaced workers of mine closures will continue to plague the sector,” the forecast concludes.

The post Coal miners to see improved finances: Fitch appeared first on MINING.com.

Source: Mining.com