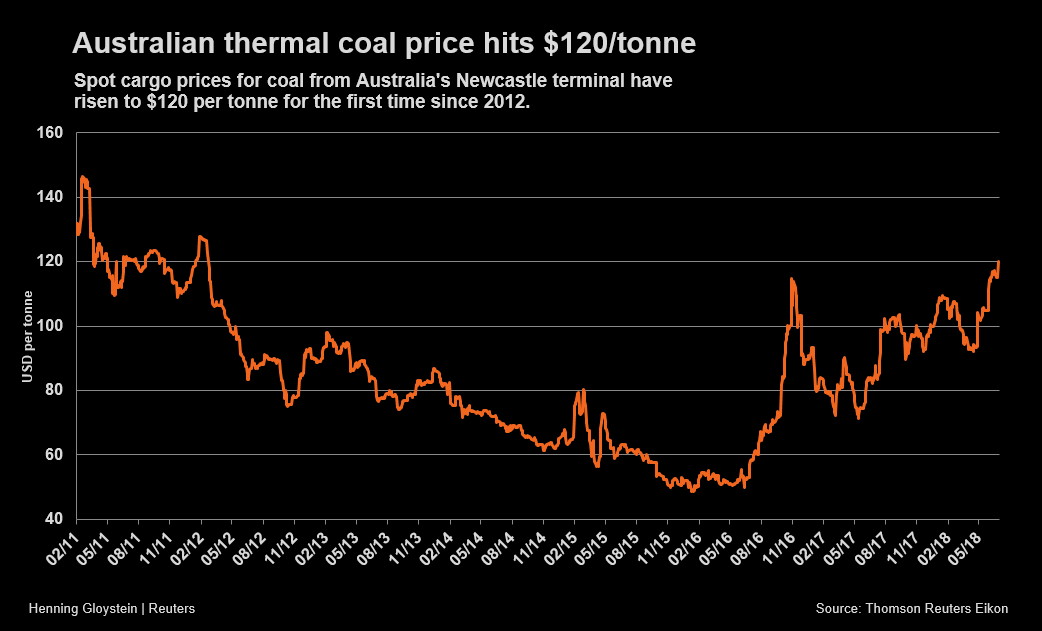

Benchmark seaborne thermal coal prices jumped to $120.10 per tonne on Thursday, its highest level since November 2012, thanks to tight supply in key Asian export regions. Measured from lows hit end-2015, early 2016 coal used in power generation has gained 140%.

Strong consumption in China, despite ongoing efforts by Beijing to reduce reliance on coal for electricity generation, and restocking from the spot market by Japanese utilities have buoyed prices.

Import demand from China has been supported by hotter than average temperatures, weak hydro power output, and limited growth in domestic supply, the Australian dept of resources said in its quarterly report released this week.

Supply in South Africa has been diverted to domestic power-generating facilities, impacting exports. In May this year prices at the African nation’s Richards Bay terminal topped $100 for the first time since April 2012 and was trending higher again this week at $106.25.

Coal at the Rotterdam port in the Netherlands is set to enter triple digits for the first time since January 2012 exchanging hands for $98.95 this week.

The Australian government forecaster said spot prices are forecast to remain well supported over the next few months, as a result of a relatively tight market, but sounded a note of caution on the longer term outlook:

However, with most of the contributing factors expected to be temporary, the price is forecast to decline from late 2018, to average US$74 a tonne in 2020 as import demand growth slows relative to supply.

Both China and India are expected to increase domestic thermal coal output.

The post Thermal coal prices hit 6-year high appeared first on MINING.com.

Source: Mining.com